When your Uber or Lyft crashes, the consequences can feel overwhelming. Unlike standard vehicle accidents, rideshare crashes involve complex insurance layers, multiple potential defendants, and unique legal considerations that most people aren’t prepared to handle.

Beyond the immediate medical and emotional stress, you’re facing questions about coverage, liability, and your rights as a passenger or injured party.

This comprehensive guide walks you through the essential steps to take after a rideshare accident in Texas, helping you protect your interests and maximize your recovery.

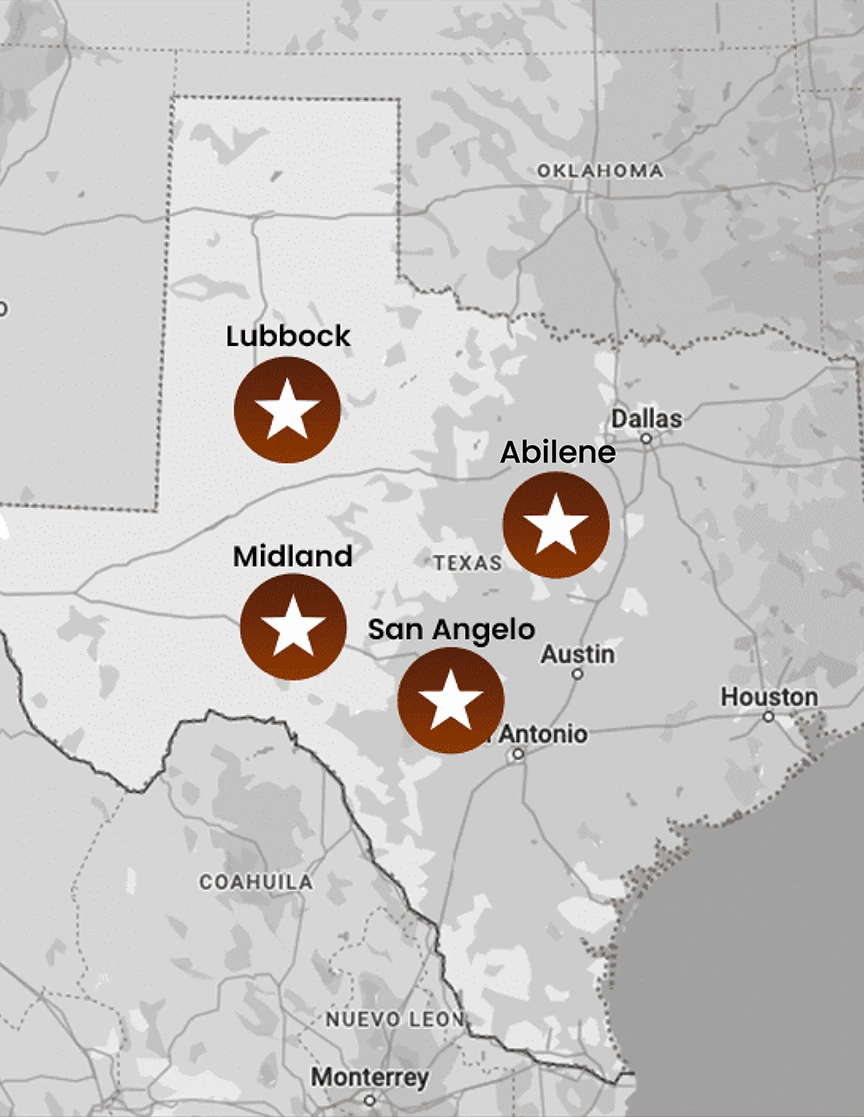

If you need immediate legal assistance following an Uber or Lyft crash, contact our experienced Abilene personal injury attorney for a free consultation.

What Makes Rideshare Accidents Different?

⚖️ Liability in Uber and Lyft crashes hinges on app status and driver classification. Texas law’s comparative fault rules and opt-out PIP laws make local legal knowledge especially valuable.

Rideshare accidents present unique complexities that distinguish them from traditional car accidents.

Knowing these differences is essential for protecting your rights and securing fair compensation.

- Multiple insurance layers create confusion: Unlike standard accidents involving two personal auto policies, rideshare crashes involve a complex web of coverage. You’re dealing with the driver’s personal insurance, Uber or Lyft’s corporate policies, and potentially third-party insurance if another vehicle is involved. Each insurer has different coverage limits, exclusions, and claim procedures.

- Independent contractor status complicates liability: Uber and Lyft drivers are classified as independent contractors, not employees. This classification affects how liability is determined and which insurance policies apply. The companies often attempt to shift responsibility to drivers’ personal policies, particularly when the app wasn’t actively being used for a ride.

- Coverage depends on app usage status: The insurance coverage available depends entirely on what the driver was doing when the accident occurred. Texas law requires rideshare companies to provide different coverage levels based on whether the driver was offline, waiting for a ride request, or actively transporting passengers.

- Texas-specific legal considerations: Texas operates under a modified comparative fault system, meaning you can recover damages even if you’re partially at fault, as long as your fault doesn’t exceed 50%. Additionally, Texas allows drivers to opt out of Personal Injury Protection (PIP) coverage, which can affect your immediate medical expense coverage.

Step-by-Step: What to Do After an Uber or Lyft Accident in Texas

Step 1: Ensure Your Safety

Your immediate safety takes priority over everything else. If you’re physically able:

Move to a safe location away from traffic, but don’t leave the accident scene entirely. Turn on hazard lights and set up flares or reflective triangles if available.

Call 911 immediately, even for seemingly minor accidents. Police documentation is essential for rideshare claims, and you may have injuries that aren’t immediately apparent.

Step 2: Seek Medical Attention

Many rideshare accident injuries, particularly soft tissue injuries like whiplash, don’t manifest symptoms immediately. Adrenaline can mask pain, and some injuries may not surface for hours or days.

Document all medical treatment from the emergency room visit through follow-up appointments. Delayed medical treatment can significantly impact your injury claim value.

Keep detailed records of:

- Emergency room visits

- Doctor appointments

- Physical therapy sessions

- Medication prescriptions

- Medical imaging results

Step 3: Document the Scene 📸

Comprehensive documentation strengthens your case significantly. Take photos of:

| Documentation Type | What to Capture |

|---|---|

| Vehicle Damage | All vehicles involved, from multiple angles |

| License Plates | All vehicles, including the rideshare vehicle |

| Road Conditions | Weather, lighting, traffic signals, road signs |

| Injuries | Visible injuries (if comfortable doing so) |

| App Screenshots | Your ride status, driver information, route |

Screenshot your rideshare app showing the active ride, driver details, and trip information. This evidence can disappear quickly and is essential for establishing the driver’s status at the time of the accident.

Step 4: Report the Accident

Texas law requires reporting accidents involving injury, death, or property damage exceeding $1,000. The responding officer will create an official report that insurance companies and courts consider reliable evidence.

Report through the Uber or Lyft app immediately. Both companies have in-app reporting features that create an official record. However, don’t rely solely on the driver to report the accident – rideshare companies need to hear from you directly.

Step 5: Don't Speak to Insurance Alone

Insurance adjusters, whether from Uber, Lyft, or other parties, may contact you quickly after the accident. Avoid giving recorded statements without legal counsel present. These statements can be used against you later.

Insurance companies are profit-driven businesses that aim to minimize payouts. They may:

- Pressure you to accept quick settlements

- Misrepresent coverage limits

- Claim the accident wasn’t covered

- Argue that your injuries aren’t related to the crash

Step 6: Contact our Texas Rideshare Lawyer

Given the complexity of rideshare accidents and the substantial insurance coverage available (up to $1 million during active rides), legal representation is essential.

Our experienced rideshare accident attorney will:

- Identify all liable parties and insurance policies

- Handle all communication with insurance companies

- Investigate the accident thoroughly

- Calculate your full damages, including future medical needs

- Negotiate for maximum settlement or file a lawsuit if necessary

With so much at stake, having our attorney will make all the difference. Let us handle the legal work while you focus on recovery.

Rideshare accident claims move fast, and so should you. Schedule your free consultation today to protect your rights and let our team fight for the compensation you deserve.

Who Pays for Your Injuries in a Rideshare Crash?

The insurance coverage available depends on the driver’s status when the accident occurred. Knowing these scenarios helps you know what coverage to pursue.

✔️ Uber and Lyft provide up to $1 million in coverage during active rides. Knowing which policy applies can mean the difference between full compensation and denied claims.

Driver Off Duty

When the rideshare app is turned off, only the driver’s auto insurance applies. Unfortunately, most personal policies exclude coverage for commercial activities, potentially leaving you with limited options.

Driver Waiting for Ride Requests

When the app is on but no ride is active, Uber and Lyft provide contingent coverage:

- $50,000 per person for bodily injury

- $100,000 per accident for bodily injury

- $25,000 for property damage

This coverage only applies if the driver’s insurance doesn’t cover the accident.

Driver En Route to Pick You Up or During Your Ride

This scenario provides the most robust coverage:

- $1,000,000 in liability coverage

- $1,000,000 in uninsured/underinsured motorist coverage

- Comprehensive and collision coverage for the vehicle

Recoverable Damages

| Damage Type | Description |

|---|---|

| Medical Expenses | Emergency care, surgery, rehabilitation, and future medical needs |

| Lost Wages | Current and future earning capacity |

| Pain and Suffering | Physical pain, emotional distress, reduced quality of life |

| Property Damage | Personal items damaged in the crash |

Wondering how much your case could be worth? Read our guide on what the average payout is for a rear-end collision to get a better sense of potential compensation ranges based on injury type and case factors.

Can You Sue Uber or Lyft in Texas?

Due to their independent contractor model, Uber and Lyft have limited direct liability for accidents. However, you may have grounds to sue the companies directly in certain situations:

- Negligent hiring or retention: If the company failed to properly screen a driver or continued employing someone with a dangerous driving record, you may have a direct claim against Uber or Lyft.

- Failure to act on prior complaints: If the company ignored multiple complaints about a driver’s unsafe behavior, it could be liable for negligent supervision.

- App-related negligence: If the company’s app design or functionality contributed to the accident, product liability claims may apply.

- The value of legal counsel: These direct claims against rideshare companies are complex and require extensive legal expertise. Our experienced attorney will evaluate whether you have grounds for such claims and pursue all available avenues for compensation.

Common Causes of Uber & Lyft Accidents

Knowing common accident causes can help you identify liability and strengthen your case:

- App-related distracted driving: Drivers frequently interact with their phones while driving, checking for new ride requests, using GPS navigation, or communicating with passengers. This divided attention significantly increases accident risk.

- Driver fatigue from long shifts: Many rideshare drivers work extended hours or multiple jobs to make ends meet. The National Highway Traffic Safety Administration reports that drowsy driving causes approximately 100,000 crashes annually.

- Unsafe pick-up and drop-off locations: Drivers often stop in traffic lanes, double-park, or make sudden maneuvers to reach passengers. These behaviors create dangerous conditions for other drivers and pedestrians.

- Speeding and reckless driving: The pressure to complete rides quickly and maximize earnings can lead to aggressive driving behaviors, including speeding, tailgating, and unsafe lane changes.

- Poor vehicle maintenance: Since drivers are responsible for their own vehicle maintenance, some may defer necessary repairs to save money, creating safety hazards.

💡 Rideshare drivers often face pressure to multitask, drive long hours, or stop in unsafe spots—all of which raise the risk of serious crashes.

Contact Our Texas Uber & Lyft Accident Attorneys

Don’t go through the complex world of rideshare accident claims alone. Our experienced Texas rideshare accident attorneys understand the unique challenges these cases present and are committed to fighting for our clients’ rights.

Worried about legal fees? Learn how our no-win, no-fee policy ensures you pay nothing unless we secure compensation on your behalf.

Time is critical in rideshare accident cases. Evidence disappears, witnesses forget details, and insurance companies begin building their defense immediately. Contact us now to protect your rights and secure the compensation you deserve.

Contact our experienced legal team online or call us at (325) 246-9410. We’ll evaluate your case, explain your rights, and develop a strategy to maximize your recovery.

Frequently Asked Questions

What Should I Do if I Were a Passenger During the Crash?

As a passenger, you’re typically not at fault for the accident. Focus on documenting your injuries, seeking medical attention, and preserving evidence. You may have claims against the rideshare driver, other drivers involved, and the rideshare company’s insurance. Contact our team at 325-225-0143 to discuss your specific situation.

Can I Sue Both the Driver and Uber?

Yes, you can pursue claims against multiple parties. This might include the rideshare driver’s personal insurance, Uber or Lyft’s commercial policies, and other drivers involved in the accident. Our attorney will help identify all potential sources of compensation.

How Long Do I Have to File a Rideshare Injury Claim in Texas?

Texas has a two-year statute of limitations for personal injury claims, as outlined in Texas Civil Practice and Remedies Code Section 16.003. However, you should act much sooner to preserve evidence and begin the claims process.

What Is the Average Uber Crash Settlement in Texas?

Settlement amounts vary dramatically based on injury severity, liability, and available insurance coverage. With up to $1 million in coverage during active rides, settlements can range significantly depending on the specific circumstances of each case.

Will My Health Insurance Pay for My Injuries?

Your health insurance may cover initial treatment, but you typically seek reimbursement from any settlement you receive. This process, called subrogation, can be complex and requires careful handling to protect your interests.