If you’re receiving Supplemental Security Income (SSI) benefits and have received or are expecting a settlement, you might be wondering whether the Social Security Administration (SSA) will discover it. The short answer is yes, SSI will almost certainly find out about your settlement.

However, with proper planning and legal guidance, you can protect your benefits while managing your settlement funds responsibly.

The SSA has multiple systems in place to monitor recipients’ finances, and failing to report a settlement can result in serious consequences, including benefit termination and penalties. For Texas residents, losing SSI benefits often means losing Medicaid coverage as well, making proper settlement planning even more critical.

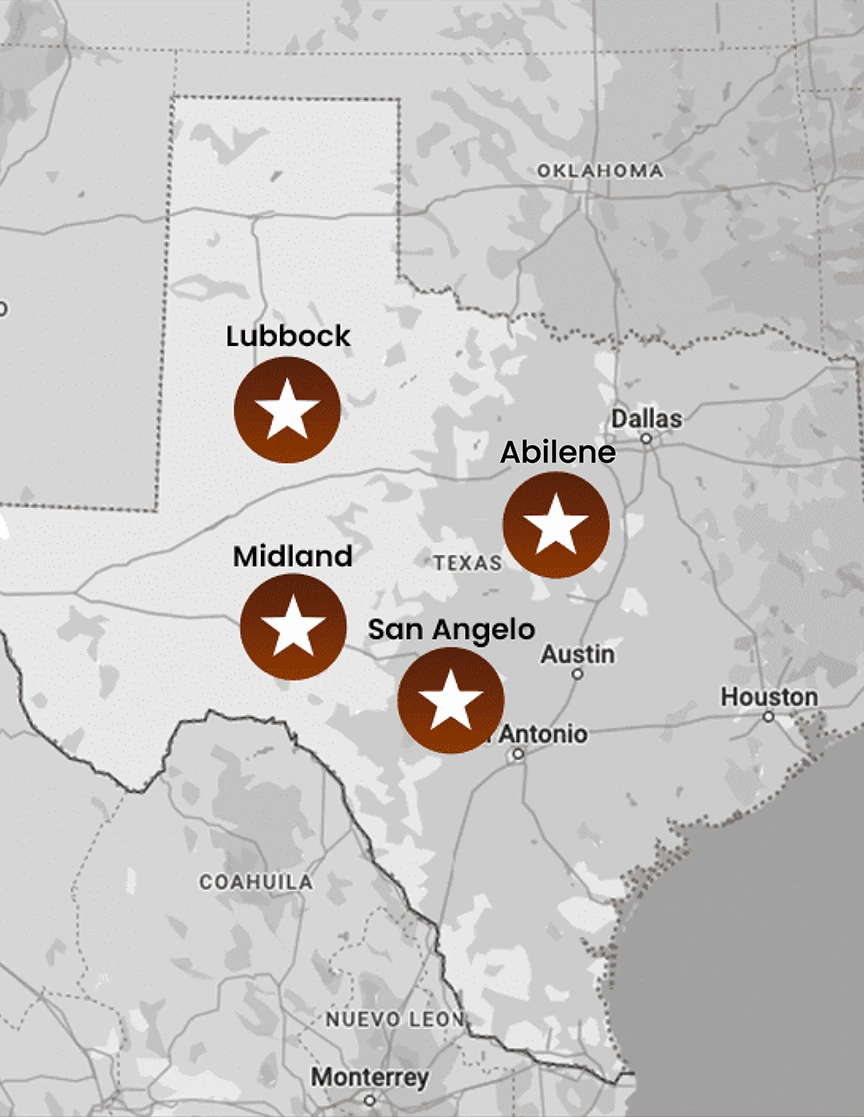

Our experienced Texas attorneys understand the complex relationship between settlements and SSI benefits. Contact our Lubbock personal injury lawyer for guidance on protecting your SSI benefits after a settlement.

How SSI Finds Out About a Settlement

The SSA employs several sophisticated methods to discover unreported settlements, making it nearly impossible to hide significant financial changes.

💡 The SSA’s layered monitoring system means there’s virtually no way to “hide” a settlement. Instead of thinking in terms of avoidance, recipients should think in terms of strategy: planning upfront is what makes the difference between losing benefits and keeping them.

Self-Reporting Requirements in Texas

SSI recipients have a legal obligation to report settlements within 10 days of receiving them. This federal requirement applies to all Texas recipients and includes personal injury settlements, workers’ compensation awards, insurance payouts, and legal settlements of any kind.

Failure to report within this timeframe can trigger overpayment notices and potential fraud investigations.

Insurance & Medicare Reporting (MMSEA Section 111)

Under the Medicare, Medicaid, and SCHIP Extension Act, insurance companies must report settlements to the Centers for Medicare & Medicaid Services (CMS). When an insurance company settles a claim for more than $750, they’re required to report the settlement amount, the recipient’s Social Security number, the date of settlement, and the type of claim.

This information flows directly into federal databases that SSA monitors regularly.

Bank Account Reviews & Financial Redeterminations

The SSA conducts periodic financial reviews of SSI recipients, typically every one to six years. During these redeterminations, they examine bank statements and financial records, looking for unexplained deposits or assets that don’t align with reported income.

Data Sharing Between Agencies

Federal agencies share information extensively. The SSA regularly exchanges data with the Internal Revenue Service, Centers for Medicare & Medicaid Services, Texas Medicaid, and the Department of Veterans Affairs. This inter-agency cooperation makes it virtually impossible to receive a significant settlement without the SSA learning about it.

What Happens If SSI Finds Out About a Settlement?

When the SSA discovers an unreported settlement, the consequences can be severe and long-lasting.

Impact on Eligibility

Settlement funds are considered income in the month received and become a countable resource if retained beyond that month. Since SSI recipients cannot have more than $2,000 in countable resources, most settlements will exceed this limit and affect benefit eligibility.

Possible Consequences

The SSA can impose several penalties for unreported settlements:

- Benefit Reduction or Termination: Benefits may be reduced dollar-for-dollar or completely terminated if resources exceed limits

- Overpayment Recovery: The SSA will calculate overpayments from the date you should have reported the settlement and demand repayment

- Fraud Penalties: Intentional failure to report can result in fraud charges and potential criminal prosecution

Texas-Specific Considerations

Texas SSI recipients face additional challenges because SSI eligibility is tied to Medicaid coverage. Losing SSI often means losing access to Texas Medicaid health coverage, SNAP benefits, housing assistance programs, and utility assistance through state programs.

The Texas Health and Human Services Commission coordinates these benefits, making proper settlement planning essential for maintaining comprehensive support services.

Legal Strategies to Protect Your SSI Benefits After a Settlement in Texas

With proper legal planning, you can receive a settlement while preserving your SSI benefits. Several strategies allow you to manage settlement funds without jeopardizing your eligibility.

Spend-Down Strategies

One immediate option is to “spend down” your settlement on exempt purchases before the next month begins. The SSA allows settlements to be spent on:

- Outstanding medical bills and medical equipment

- Debt repayment (credit cards, loans, back rent)

- Vehicle purchase or repairs (one vehicle per household)

- Home repairs and modifications

- Essential furniture and appliances

- Burial fund contributions (up to $1,500)

- Educational expenses and job training

The spend-down strategy requires careful documentation and must be completed before the next month begins to avoid resource limit violations.

⚖️ Spend-downs, Special Needs Trusts, ABLE accounts, and structured settlements aren’t loopholes — they’re legal mechanisms built into the system. Using the right one not only protects benefits but also demonstrates compliance and transparency.

Special Needs Trusts in Texas

A Special Needs Trust (SNT) offers the most flexible long-term protection for larger settlements. This legal arrangement allows settlement funds to be held and managed for your benefit without counting as a resource for SSI purposes.

First-Party Special Needs Trusts must meet strict SSA requirements:

- Must be established before age 65

- Must benefit only the disabled individual

- Must include Medicaid payback provisions

- Must be irrevocable once funded

Texas courts have specific procedures for establishing court-approved SNTs. The Texas Estates Code provides the framework for these trusts, but they must be drafted by experienced attorneys to ensure SSA compliance.

ABLE Accounts in Texas

Achieving a Better Life Experience (ABLE) accounts provide another option for younger disability benefit recipients. These tax-advantaged savings accounts allow you to save up to $18,000 per year (2025 limit) without affecting SSI eligibility.

To qualify for an ABLE account, your disability must have occurred before age 26. The Texas ABLE program, administered by the Texas Prepaid Higher Education Tuition Board, offers these accounts to eligible residents.

Structured Settlements

Instead of receiving a lump sum, you can arrange for periodic payments through a structured settlement. This approach spreads the settlement over months or years, helping you stay within SSI resource limits while providing ongoing income without creating large resource accumulation.

Don’t risk losing your SSI benefits—contact us now for a free consultation and personalized settlement planning.

Reporting Your Settlement to the SSA

Proper and timely reporting is essential for maintaining your SSI benefits and avoiding penalties.

Why Prompt Reporting Matters

The 10-day reporting requirement is a federal mandate that allows the SSA to calculate any necessary benefit adjustments, provide guidance on managing settlement funds, and avoid overpayment situations.

Required Documentation

When reporting your settlement, provide the SSA with:

- Complete settlement agreement showing all terms and conditions

- Payment records documenting when and how funds were received

- Attorney fee statements showing any legal costs deducted

- Documentation of fund usage for any immediate expenditures

- Trust or ABLE account information if funds were placed in these vehicles

Settlement Planning Checklist for Texas SSI Recipients

When you receive a settlement while on SSI, follow this checklist to protect your benefits:

- Report to SSA within 10 days of receiving the settlement

- Calculate the total settlement amount, including interest and attorney fees

- Review spend-down options for exempt purchases

- Consider a Special Needs Trust for amounts over $5,000

- Evaluate ABLE account eligibility if under 26 at disability onset

- Document all expenditures with receipts and records

- Consult with our qualified attorney before making major decisions

- Notify the Medicaid office about settlement and benefit protection strategies

📌 This checklist isn’t just a reminder — it functions as a defense plan. Each step (from reporting within 10 days to documenting expenditures) creates a legal safety net that helps prove compliance if the SSA questions your eligibility. Skipping even one step can turn a manageable settlement into a benefits crisis.

Get Your Free Consult With Our Lubbock Personal Injury Lawyers

At Keith & Lorfing, we understand that SSI benefits often represent the difference between financial stability and hardship for Texas families.

Our unique qualifications include:

- Extensive SSI and settlement experience: We help Texas clients protect their benefits while managing settlement funds

- Local court relationships: Our attorneys practice regularly in West Texas courts and understand local procedures for establishing Special Needs Trusts

- Comprehensive planning approach: We coordinate with financial planners, accountants, and other professionals to ensure complete benefit protection

- Aggressive advocacy: When the SSA makes incorrect decisions, we fight for our clients’ rights through appeals and hearings

Our attorneys combine deep knowledge of federal disability law with practical experience in Texas courts and state agencies.

The 10-day reporting requirement means time is critical when you receive a settlement. Call Keith & Lorfing at (325) 480-8100 today to schedule a free consultation with our experienced Texas attorneys about safeguarding your SSI benefits and making the most of your settlement.

FAQs About SSI and Settlements in Texas

Can SSI take my settlement money?

No, the SSA cannot directly take your settlement money. However, if your settlement pushes your resources over $2,000, your SSI benefits will be suspended or terminated until your resources fall below the limit again.

How long after a settlement will SSI find out?

The SSA typically discovers settlements within 30-90 days through their automated reporting systems. Insurance companies report settlements under Section 111 requirements, and this information flows directly to SSA databases.

Will my SSI benefits stop if I get a settlement in Texas?

Not necessarily. With proper planning using Special Needs Trusts, ABLE accounts, and spend-down plans, you can preserve your SSI benefits even after receiving a settlement.

What happens if I don't report a settlement to SSI?

Failure to report can result in benefit termination, overpayment recovery, and potential fraud charges. The SSA may demand repayment of all benefits received from the date you should have reported the settlement.

Can I spend my settlement on anything to avoid SSI penalties?

No, only certain expenditures are exempt under SSI rules. You can spend settlement funds on medical bills, debt repayment, vehicle purchase, home repairs, essential furniture, and educational expenses. Luxury items, investments, or gifts to others won’t protect your SSI eligibility.