Being involved in a car accident is stressful enough—but when you’re uninsured and the other driver caused the crash, it can feel like you’re facing an impossible situation. While Texas law requires all drivers to maintain minimum insurance coverage, you may still have rights to compensation if another driver was responsible for your accident.

Many uninsured drivers mistakenly believe they have no recourse after an accident, even when they weren’t at fault. This misconception often leads to victims failing to pursue legitimate claims, potentially losing thousands in compensation for medical bills, lost wages, and vehicle repairs.

💡 Texas is a fault-based state, meaning the at-fault driver is responsible for damages—regardless of your insurance status. You still have a right to file a claim and pursue compensation.

Without proper legal guidance, insurance companies may take advantage of your uninsured status to deny or minimize your rightful claim.

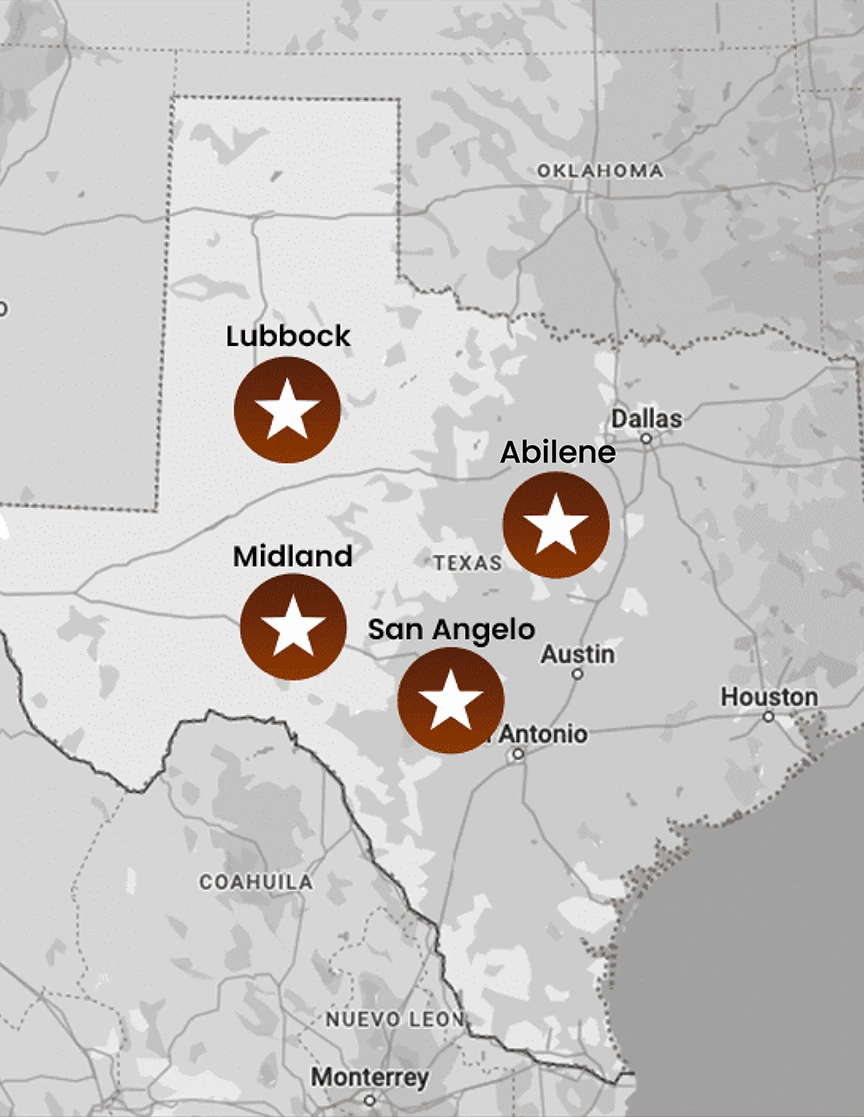

Our Abilene Car Accident Lawyer understands the complexities of uninsured driver claims and will help protect your rights.

Texas Fault Laws and Insurance Requirements

Texas operates under a “fault” or “tort” system for car accidents. This means the person responsible for causing an accident is also responsible for paying the resulting damages.

Minimum Insurance Requirements in Texas

Under Texas law, drivers must maintain minimum liability insurance coverage of:

- $30,000 for injuries per person

- $60,000 total for injuries per accident

- $25,000 for property damage

These requirements, established by the Texas Department of Insurance, exist to ensure that drivers can cover costs if they cause an accident. The Texas Transportation Code §601.051 specifically requires this financial responsibility from all motorists operating vehicles in the state.

The Importance of Liability Coverage

Liability insurance isn’t just a legal requirement—it provides essential protection for all road users. Approximately 1 in 8 Texas drivers are uninsured, creating significant risks for everyone on the road.

While you’re required to have insurance, lacking coverage doesn’t automatically bar you from compensation if another driver caused your accident.

What Happens if You Have No Insurance but Were Not at Fault?

If you’re uninsured but another driver caused your accident, you still retain the legal right to file a claim against the at-fault driver’s insurance company.

You Can Still File a Claim Against the At-Fault Driver

Texas law allows you to seek compensation from the at-fault driver’s insurance, regardless of your own insurance status. This includes coverage for:

- Medical expenses

- Lost wages

- Property damage

- Pain and suffering

⚠️ Insurance adjusters may lowball your claim or delay payment. Our experienced attorney will fight for full compensation—even without your own insurance policy.

The Risk of Reduced Settlements

While you maintain the right to compensation, being uninsured can sometimes complicate your claim. Insurance companies may attempt to use your uninsured status to:

- Question your credibility

- Argue you were partially at fault

- Offer lower settlements

According to data from the Insurance Research Council, uninsured drivers often receive settlement offers 15-30% lower than insured drivers with similar claims—even when not at fault.

The Need for Strong Legal Representation

Given these challenges, having experienced legal representation becomes even more important when you’re uninsured.

In a hypothetical scenario, imagine you’re driving to work in Midland when another driver runs a stop sign and T-bones your car. You suffer a broken arm and whiplash. The other driver’s insurance adjuster learns you’re uninsured and offers a quick $5,000 settlement—far below what’s needed for your medical care and lost wages. Without legal knowledge, you might accept this inadequate offer out of fear of getting nothing.

Penalties for Driving Without Insurance in Texas

While pursuing compensation from the at-fault driver, you should also be aware of the potential penalties for driving without insurance.

Fines and Financial Penalties

| Second offense | $350-$1,000 | Court costs, surcharges |

| Repeat offenses | Up to $1,000 | Court costs, surcharges |

These fines are established under Texas Transportation Code §601.191 and are enforced regardless of whether you cause an accident.

License Suspension Risks

The Texas Department of Public Safety (DPS) may suspend your driver’s license if you’re caught driving without insurance. Typically, suspension periods range from:

- 90 days for first offenses

- Up to 2 years for subsequent offenses

Vehicle Impoundment Possibilities

In some cases, law enforcement may impound your vehicle if you’re caught driving without insurance, particularly for repeat offenses. Reclaiming your vehicle requires:

- Paying all towing and storage fees

- Showing proof of insurance

- Settling any outstanding fines

SR-22 Requirements

After being caught without insurance, you’ll likely need to file an SR-22 certificate with the state. An SR-22:

- Verifies you have the minimum required insurance

- Must be maintained for typically 2-3 years

- Costs more than standard insurance policies

Drivers with SR-22 requirements pay an average of 30% more for their auto insurance policies. Keep digital proof of insurance on your phone as a backup, as physical insurance cards can be lost or forgotten.

Facing fines or impoundment? Contact our Texas Car Accident Lawyer now for a free consultation.

How to Protect Your Rights After a Car Accident Without Insurance

If you’re involved in an accident without insurance but weren’t at fault, taking the right steps immediately afterward is essential to protecting your legal rights.

Stay Calm and Gather Evidence

After a car accident, taking the right steps can protect your safety, support your insurance claim, and preserve important evidence. Here’s what to do immediately at the scene:

- Check for injuries and call 911 if needed

- Take photos of all vehicles involved, the accident scene, road conditions, and traffic signals or signs

- Collect contact information from the other driver(s), any witnesses, and responding officers

⚖️ Getting legal help immediately protects you from being taken advantage of. Our attorney will handle the insurance company so you don’t get steamrolled.

Ensure a Police Report is Filed

A police report provides an official record of the accident and is critical evidence for your claim. Make sure the officer:

- Takes your statement

- Documents the scene

- Issues citations to the at-fault driver if applicable

You can request a copy of the report from the Texas Department of Transportation Crash Report Online Purchase System.

Avoid Admitting Fault

Be careful about what you say aftxer an accident:

- Don’t apologize or admit fault

- Stick to the facts when speaking with police

- Decline to give recorded statements to insurance companies without legal representation

Hypothetical Scenario: James, an uninsured driver, is stopped at a red light in Lubbock when he’s rear-ended by a texting driver. Initially feeling guilty about his lack of insurance, James apologizes to the other driver. Despite the accident clearly being the other driver’s fault, this apology is later used to argue shared responsibility, reducing James’s potential settlement.

Contact our Personal Injury Attorney Immediately

When you’re uninsured, the expertise of our attorney becomes even more valuable. Our experienced lawyer will:

- Handle communications with insurance companies

- Protect you from unfair tactics

- Build a strong case despite your uninsured status

Can You Still Recover Compensation?

Yes, you can still recover compensation even without insurance, but the process may be more challenging.

Filing Third-Party Claims Against the At-Fault Driver

In Texas, you have the right to file a third-party claim directly with the at-fault driver’s insurance company. This claim process typically involves:

- Notification of the claim

- Investigation by the insurance company

- Evidence review

- Settlement negotiations or litigation

Types of Damages You Can Recover

Even without insurance, you may be entitled to significant compensation, including:

| Type of Damage | Examples | Documentation Needed |

| Medical expenses | Hospital bills, therapy costs, medications | Medical records, bills, receipts |

| Lost wages | Income lost during recovery | Pay stubs, employment records |

| Property damage | Vehicle repair/replacement, personal property | Repair estimates, receipts |

| Pain and suffering | Physical pain, emotional distress | Medical documentation, personal testimony |

Real Case Example: Our client Raul, an uninsured construction worker, was severely injured when a commercial truck ran a red light in Midland. Despite being uninsured, we secured a $275,000 settlement covering his extensive medical bills, lost wages during his 8-month recovery, and pain and suffering.

The Role of Comparative Fault in Texas

Texas follows a “modified comparative negligence” rule with a 51% threshold. This means:

- You can recover damages as long as you’re not more than 50% responsible for the accident

- Your compensation is reduced by your percentage of fault

- If you’re found 51% or more at fault, you cannot recover damages

For example, if you’re awarded $100,000 but found 20% at fault, you would receive $80,000.

Challenges You Might Face Without Insurance

Being uninsured presents several obstacles when pursuing compensation after an accident.

Insurance Companies May Try to Blame You

Insurance adjusters often use an uninsured status to portray a driver as irresponsible. They may:

- Scrutinize your driving record more closely

- Question your account of the accident

- Look for ways to shift blame to you

⚠️ Insurance companies may try to label you as irresponsible and deny your claim. That’s why documentation and legal representation are critical.

In Texas, your insurance status is generally not admissible in court as evidence of fault in the accident itself.

Potential Lower Settlement Offers

Research from the Insurance Information Institute shows that uninsured drivers typically receive initial settlement offers 25-40% lower than insured drivers with comparable injuries.

Insurance companies may:

- Assume you’re desperate for any settlement

- Exploit your concern about potential penalties

- Use aggressive negotiation tactics

Difficulty Negotiating Without Legal Help

Without our attorney, you may face:

- Complex legal terminology designed to confuse

- Pressure to accept quick, low settlements

- Intimidation tactics from experienced adjusters

In a hypothetical scenario, consider Sarah, who is rear-ended at a stoplight in San Angelo. The other driver is clearly at fault, but when the insurance company discovers Sarah is uninsured, they offer only $2,000 for her $15,000 in medical bills. Without legal representation, Sarah might accept this inadequate offer out of fear of receiving nothing due to her uninsured status.

Get A Free Consultation With Our Texas Car Accident Lawyers

At Keith & Lorfing, we understand the unique challenges uninsured drivers face after accidents that weren’t their fault. Our team of experienced West Texas attorneys has successfully helped numerous uninsured clients recover the compensation they deserved.

We believe everyone deserves quality legal representation, regardless of insurance status. Our approach includes:

- Free initial consultations

- No upfront fees

- Payment only when we win your case

- Aggressive negotiation with insurance companies

- Trial representation when necessary

Need help after an accident? Contact us online or call (325) 225-0953 for your free case evaluation today.

Key Takeaways

- Being uninsured doesn’t eliminate your right to compensation when another driver is at fault

- Texas’s fault-based system allows claims against the at-fault driver’s insurance

- You may face penalties for driving uninsured, but these are separate from your accident claim

- Proper documentation and legal representation are critical to maximizing your compensation

- Insurance companies may try to use your uninsured status against you

- Working with our experienced car accident attorney significantly increases your chances of a fair settlement

FAQs

What should I do immediately after an accident if I don't have insurance?

Stay at the scene, check for injuries, call the police, and gather evidence including photos and witness information. Don’t discuss your insurance status with the other driver, but be honest with police if asked directly. Contact our car accident attorney as soon as possible.

Can I still receive compensation for my injuries if I don't have car insurance?

Yes, you can still pursue compensation for your injuries from the at-fault driver’s insurance company even if you’re uninsured. Texas law permits you to recover damages regardless of your insurance status, though the process may be more challenging.

Will my case go to court if I don't have insurance?

Most car accident claims settle without going to court, regardless of insurance status. However, if the insurance company refuses a fair settlement, we’re prepared to take your case to trial. Our attorneys have extensive courtroom experience fighting for uninsured clients.

How long do I have to file a claim after an accident in Texas?

Texas has a two-year statute of limitations for personal injury claims, including car accidents. This means you must file your lawsuit within two years of the accident date or lose your right to compensation. Contact our attorney promptly to protect your rights.